Did you hear about the new FHA waiver suspending the 90-day no-flip rule?

Did you hear about the new FHA waiver suspending the 90-day no-flip rule?

I first caught wind of it Friday through a forum post, then again on Cory’s blog and on CNN.

The CNN article says…

“The Bush administration is temporarily suspending a 5-year-old rule intended to deter property flippers, as part of an effort to help speed the sale of foreclosed properties. For one year, the Federal Housing Administration will no longer impose a 90-day waiting period before foreclosed properties can be sold to receive government-backed loans.”

Break Out the Bubbly! Let the People Rejoice!…Right?

Don’t uncork that bottle just yet, my friend.

Yes, at first glance a lot of investors (including me) saw this as an incredible break for investors who, since 2003, have had to deal with a “90 days of ownership seasoning” requirement before our properties could be sold to buyers using FHA financing.

Sadly this is still the case.

Whether we like it or not (I know I don’t) the 90-day seasoning policy was place in 2003 to deter what the FHA in it’s infinite wisdom determined to be property “flipping” schemes.

Apparently this new “waiver” doesn’t phase this limitation at all.

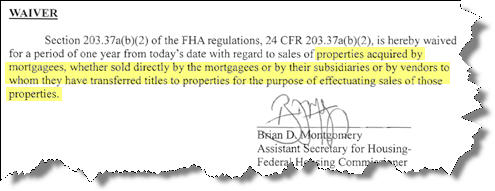

If you carefully review the PDF of the actual waiver from HUD’s website, you’ll notice this little tidbit…

So What DOES This Mean?

Simply this…

- FHA financing is NOW available to borrowers purchasing properties owned less than 90 days that were acquired by foreclosure by mortgagees (i.e. lenders)

- This also includes any subsidiary of the lender or vendors used to market and sell property.

- This waiver applies whether or not the mortgagee is state-or federally-chartered (which was previously a restriction).

The Bottom Line for Investors…

Sorry, but nothing changes for us, because…

- You’re not a “mortgagee” unless you’re the one who actually foreclosed on the property.

- You’re not a “vendor” unless you actually have a contract of some sort in place with one of the lenders.

There is no verbiage in the waiver that states or even suggests it applies unless you’re one of the above.

Business as usual, folks. Move along…

JP – I saw the verbiage you’re referring to, and I will not deny that one can make a case for what you’re saying. However, I think we’ll have to determine if there’s any special definition assigned to the word “vendor” per the original regulations. If there is not a special definition, then I’m not sure if your conclusion is correct.

The point is: I don’t know. I’ll look into it now. If anyone figures it out, let me know.

@Bryan Ellis -Bryan,

It seems to me that the “vendor” in this case is someone who’s in place to help the mortgagee get it sold. I’m not exactly sure who that would be — like an example. But it sure doesn’t sound like an investor who buys it then wants to resell.

If you (or anyone) gets a clearer definition of “vendor” that might imply otherwise, please let me know. It would give me great pleasure to re-post that I’m mistaken! 🙂

Thanks!

Thanks, JP. I would recommend your post to anyone who wants to learn more about this issue. While I see your points and find them to be excellent, don’t you think it’s a little soon to be saying that the FHA’s temporary “anti-flipping” rule suspension will have no absolutely no impact on the REI community?

As I said, “many flippers may find that this policy change id of little help to their businesses.” Still, I believe that the policy change is likely to have a positive effect on the real estate markets that have been choking on foreclosures. When that happens, we’ll have more options to develop and implement strategies to make money in real estate. I see this as a plus.

Like many of us, I’ve looked at FHA’s waiver language and puzzled over how they’re defining “vendor.” Still, providing for any sort of “middleman” position in between REO lenders and the market is likely to benefit investors either directly (if some of us assume that position and manage to profit from it) or indirectly (if the policy change succeeds in its goal of stabilizing prices and stimulating market activity).

Even if real estate investors become “vendors,” rehabbing costs are higher than ever, so bringing many of these foreclosure properties up to FHA guidelines poses an awesome challenge, even if weren’t for the massive price drops we’ve seen in real estate markets hard-hit by foreclosure. Still, I have faith that if anybody can find a way to make money here, the REI community can. Although it may be too soon to know exactly how REI will capitalize on this development, the innovation and resilience I see in our community always amazes me.

Buying homes when prices are down and selling them when prices rise is an excellent strategy for investing in real estate, but most of us prefer to have more than one way out of a deal. If FHA’s waiver succeeds in providing real estate investors with options, then I see it as a positive step — even if it’s a small one.

Another point that I made in my post is that the Fed’s so-called “anti-flipping policy” did more to reveal the government’s generalized ignorance about how our industry works than it did to protect consumers. Their rationale for implementing this policy was to discourage the “predatory lending” and collusion they automatically associate with flipping. Has this policy protected anyone? Or did it unfairly seek to regulate our business practices without legitimate cause?

Looking at many of the loans that lenders extended to consumers, it seems to me that the Fed’s time and money would have been better spent scrutinizing the real predatory lenders. Now, by suspending its so-called “anti-flipping” policy, the Fed is going out on yet another limb for suffering REO lenders who, like consumers, should have known better than to get involved with the risky mortgages to begin with. Who pays for these mistakes? If you operate your own business, you know the answer.

I agree that this isn’t an occasion for Champagne. But what’s a good mixer for irony? If you need a chaser, try this: It appears that in 2003 when the Fed’s “anti-flipping” policy went into effect, then Housing and Urban Development (HUD) Deputy Secretary Alphonzo Jackson was getting a sweetheart mortgage deal from Contrywide’s head Angelo Mozilo. You may recall that Jackson resigned from his leadership post at HUD a few months ago amid accusations of cronyism.

Go get ’em JP. Your post on this issue are among the best I’ve seen. Please, keep on sharing you lively wisdom and analytical skills with the rest of us. Let’s hope that your common sense is as contagious as the foreclosure epidemic in Florida!

If anyone wants to check out my coverage of this issue: http://www.garyboomershine.com/blog/2008/06/17/fha-loans-now-for-foreclosure-flips-with-no-wait/

Gary Boomershines last blog post..FHA Loans Now Back Foreclosure Flips with no Wait

@Gary Boomershine – Some really excellent points in there, Gary. And never let it be said that you’re not a man of words and action. 🙂

It’s not that I don’t think the FHA waiver will have any impact at all in the REI community. But it won’t have the effect many of us thought it did initially. If someone can get clarification on exactly what kind of “vendor” the waiver might be referring to, then maybe we can figure out if/how an investor might put himself in that role. I’d appreciate anyone else’s insight on that particularly.

It also seems to me that in order for a mortgagee (lender) to be able to benefit from this waiver, they’re going to have to look at rehabbing many of the REOs in their inventory. Otherwise most of them won’t meet FHA’s standards for property condition, so the waiver would be useless. So it’ll be interesting to see how/if this effects the way banks deal with their inventory at all.

Thanks again for your insightful feedback. Anyone else?

JP, you are right on point with your information.

Great website and layout to!!!

Gerald Romines last blog post..Gerald Romine Get’s Political

@Gerald Romine – Thanks, Gerald. I’m doing my best. 🙂

…jp

Ps…LOVED the video revealing your presidential run. Congrats! 😉

After reading the actual 2 page waiver and then going back to the underlying section of the C.F.R. cited in the Memorandum it is possible that this may help short sale investors attempt a quick turn transaction. Several investors associated with Strategic Real Estate Coach Inc. are going to try submitting B to C deals to FHA lenders. The key elements are in how the entire deal is set up and openly disclosed to the FHA lender. They may see the investor as a vendor assisting the mortgagee and mortgagor in ending the foreclosure. Only time and effort will tell.

@Jeffery S Watson Esq. – Jeffrey, after you submit them I’d love to hear how it goes. I’d even love to do a short case study interview with you on it if possible. Your experience in how this goes would be invaluable to share with others in the investment community. So please keep me/us posted. Thanks for commenting!

…jp

I am a first time home buyer and ran into this FHA anti flip policy just a few weeks ago. Our situation is; the house sold in April from foreclosure to an investment company to sell it off. We are using FHA whom went all the way through the process up until 1 week before closing and then decided to tell us about this 90 days. We tried everything to waive it but to no avail. We got a call this weekend from our real estate agent saying that our mortgage broker got them to waive the 90 days. So you can in fact have the 90 days waived for a vendor that is assisting the mortgagee like said above.

@Brian Schweizer – Thanks for chiming in. That’s interesting. Do you know if the investment company you’re referring to was a company hired by the foreclosing lender to help liquidate it’s foreclosure assets? Or was it a real estate investor who purchased the property to flip for profit, and then flipped to you? If in fact the latter, then it does appear they found a way to be considered a “vendor” under the waiver guidelines.

…jp

I believe they are referring to asset management companies (whose services typically include disposition) when they use the term “vendor”…

These are the guys who secure the property, winterize them, do the critical/emergency repairs, contact local agents to get them listed, etc. The lenders typically turn the properties over to them shortly after the auction…

Just google: REO Asset Management

http://www.google.com/search?q=reo+asset+management

Well after weeks of being strung along by the FHA Lender they finally decided that we dont qualify for the waiver, even though they said back in June that we did and made us resubmit with June dates. Im getting so frusterated at this point if it was the seller jerking us around I’d have told them to get lost, but its our own lender =( The investment company that bought the house, as far as I can tell, has no affiliation with the Lender that had the foreclosure title. 3.5+months so far how much longer can we possibly get strung along….

@Brian Schweizer – Thanks for the update, Brian! So I guess it’s more proof that the FHA seasoning waiver isn’t quite the boon for investors that we initially thought. Maybe if (when?) the feds take them over, things’ll change again! 😉

My best,

..jp

Awesome point Gary Boomershine @ rehab costs, and REO companies not having anything to do with it.

So i just got off the phone with a rep from the F.H.A. Philly region, and was told that the waiver is actually intended for THE SAME reason you mentioned.

The Grantor of the property could be a “Management” or construction company etc… that specializes in doing the dirty work or something of the sort, and bringing it up to F.H.A. standards. the property could then be sold after a week’s labor or so. Good Luckk ;]

(Arent I just about the Coolest person you know right about now?)

The waiver you have posted in your article is from 2008 not the one just issued today….http://www.hud.gov/offices/hsg/sfh/waivpropflip2010.pdf

JP,

you are the only one I can find online making this argument. Everyone else seems to think this applies directly to investors who buy with the intent to wholesale or fix and flip.

Have you gotten any further clarification on this?

Jer

.-= Jerry Norton´s last blog ..91 W. Ypsilanti Pontiac, MI……………………….Available Now $69,900 =-.