So how do you make a short sale offer that the lender is sure to accept?

Well, Cory Boatright to tell you that it’s about making the right offer. And to do that, you need to follow these 5 key steps.

Okay, lots of important acronyms heading our way, here we go…

Step 1: Determine Fair Market Value (FMV)

You can determine the FMV using recently sold comparable properties (comps) near the short sale property. To find these comps, you want a Comparative Market Analysis (CMA).

A Realtor will have access to the Multiple Listing Service (MLS) and can use the MLS to create a CMA for you. The CMA will identify comps with the same square footage, number of bedrooms and baths, garage features and other similar characteristics as the subject property.

Ask the Realtor to find comps sold in the past 6-12 months. Usually the short sale lender will not consider any comps that were sold more than 12 months ago and that are farther than 2 miles away from the subject property.

Step 2: Evaluate Comps Systematically

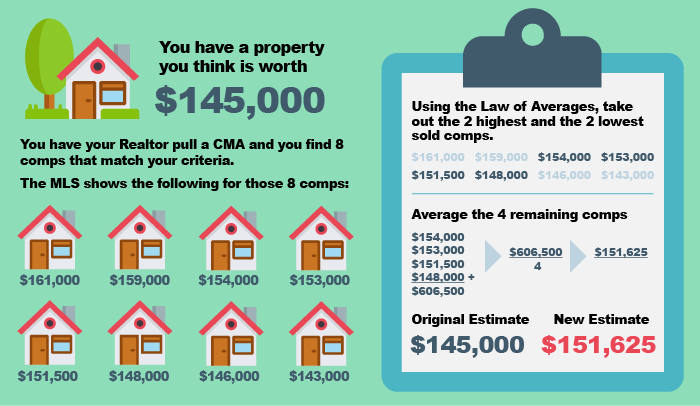

Contrary to popular belief, you can use a system to determine what to offer on a short sale property. This system has been around for years, but it’s not very well known. The system is: The Law of Averaging.

The Law of Averaging works like this…

Let’s say you have 8 comparable properties. You take out the 2 highest comps and the 2 lowest comps and average the rest.

Step 3: Reveal the After Repair Value (ARV)

The After Repair Value is similar to Fair Market Value, but it includes the cost of any repairs. The repairs to estimate would be any repairs needed in order to sell the property quickly using for sale-by-owner techniques, not using the MLS.

The ARV is an estimate based on comps from houses that were NOT sold by a Realtor.

A Realtor will typically use an FMV and a real estate investor may elect to use an ARV. An appraiser can use both value methods, but generally sticks to the ones that come from the MLS. In my opinion, the FMV tends to be more accurate and dependable than the ARV.

Step 4: Figure Out the Broker Price Opinion (BPO)

The BPO is perhaps the single greatest factor the lender will use to decide whether to accept your short sale offer.

The BPO is KING.

The BPO is a generalized value of a property that the lender uses to determine what the short sale property is worth on paper. Third-party companies (BPO Direct, First America, LandSafe, etc.) determine the BPO.

There are 2 types of BPOs: exterior and interior.

An exterior BPO means the Realtor (BPO agent) only saw the exterior of the property and did not go inside the house. If the property is vacant or if the owner isn’t cooperative, the BPO agent might not be able to see the interior of the property and be forced to only do an exterior BPO.

Lenders tend to classify houses in different ways and accept more or less of a loss depending on how the house is classified. Remember that not all houses heading toward foreclosure are good short sale candidates. They are not.

Short Sale Classifications:

Short Sale Classifications:

- Pretty House

- Ugly House

- Scary House

EXAMPLES:

Pretty House: (Generally in safe, desirable areas and houses selling fairly quickly)

ARV/FMV: $100,000

REPAIRS: $5-$10,000 (5%-10%)

BPO: $80-$90,000 +/- 5%

Ugly House: (Generally a light rehab or fixer-upper in fair neighborhoods)

ARV/FMV: $100,000 (With Ugly Houses this number tends to be the “as is” value instead of the ARV)

REPAIRS: $11-$20,000 (11%-20%)

BPO: $80,000 +/- 5%

Scary House: (Generally in areas that are not desirable, massive repairs needed)

ARV/FMV: $100,000 (With Scary Houses this value tends to be the “as is” value instead of the ARV)

REPAIRS: $35,000 (21%-35% +)

BPO: $65,000 +/- 5%-10%

Remember, these are guidelines. This isn’t an exact science.

For example, you can have a Scary House located in a great, fast-selling neighborhood. But generally speaking, Scary and Ugly Houses will not be located in excellent neighborhoods. The BPO agent will generally consider the “as is” value for both Ugly and Scary Houses.

Dealing with Pretty House short sales, you will find the BPO will typically come in 10%-20% lower than the FMV or ARV. So you might consider offering 60% of the ARV or FMV value initially. Of course, this depends on the required repairs.

If you have a Pretty House short sale, don’t expect to get a huge discount from the lender. If you cannot justify a discount from the lender, don’t expect one.

Step 5: Learn the Loan Types

When you learn the loan types, you can increase your short sale closing rate by as much as 50%. Here’s why: If you know more about a property, you are better positioned to negotiate. Not all short sales are created equal.

Conventional Loans

Conventional loans are the most common. They are also the most flexible, especially when it comes to short sales.

Remember, the BPO is the main factor for the lender. It is very common to see the lender accepting around 80%-85% of the BPO price.

So if you thought the BPO was going to come in around $65,000, you would take 82% of THAT number, which would be $53,300. The lender may very well accept $53,300 based on their perception of the value of the property (their asset).

FHA Loans

If you are dealing with an FHA loan or any government-backed loan, the lender is going to recoup a set amount if the foreclosure is completed. So the lender might consider a lower offer than if the loan were conventional.

For example, with FHA loans the insurer will basically guarantee the lender 82% of an FHA Certified Appraisal amount. For these loans, you will need an FHA Certified Appraisal for the lender to consider (the BPO won’t be enough here). You can massage the numbers 1%-2%, but 82% is listed in the FHA guidelines.

FHA Loan Quick Facts:

All FHA loans are insured by the federal government.

All FHA loans are insured by the federal government. As long as the lender follows FHA guidelines, they are guaranteed at least 82% of the “as is” appraised value.

As long as the lender follows FHA guidelines, they are guaranteed at least 82% of the “as is” appraised value. FHA loans will not use a BPO. Instead they will require an FHA Certified Appraisal. Use the same techniques on the FHA Appraisal that you would for a typical short sale deal.

FHA loans will not use a BPO. Instead they will require an FHA Certified Appraisal. Use the same techniques on the FHA Appraisal that you would for a typical short sale deal. If the debtor is in bankruptcy, no short sale will be approved.

If the debtor is in bankruptcy, no short sale will be approved. If the property was used as a rental for more than 12 months, no short sale will be approved.

If the property was used as a rental for more than 12 months, no short sale will be approved. If the homeowner does not occupy the property, no short sale will be approved. (There can be exceptions to this.)

If the homeowner does not occupy the property, no short sale will be approved. (There can be exceptions to this.) The cooperating lender is eligible to receive $1,000 from FHA for performing a short sale.

The cooperating lender is eligible to receive $1,000 from FHA for performing a short sale. Seller MUST fill out FHA specific forms for approval. This will include an Application to Participate and a Homeowners Counseling Certificate, all of which the lender will supply in their FHA Short Sale Packet.

Seller MUST fill out FHA specific forms for approval. This will include an Application to Participate and a Homeowners Counseling Certificate, all of which the lender will supply in their FHA Short Sale Packet. FHA loans must be at least 30 days past due for short sale consideration.

FHA loans must be at least 30 days past due for short sale consideration. The lender is required to give a copy of the appraisal to the homeowner.

The lender is required to give a copy of the appraisal to the homeowner. The homeowner can receive up to $1,000 directly from the HUD 1.

The homeowner can receive up to $1,000 directly from the HUD 1. FHA will not go after the homeowner for a deficiency once the short sale is accepted and closed.

FHA will not go after the homeowner for a deficiency once the short sale is accepted and closed.

VA (Veterans Affairs) Loans

VA loans have a guarantee of 88% of the appraised value of the property.

VA Loan Quick Facts:

Designed for veterans.

Designed for veterans. These loans are federally insured.

These loans are federally insured. VA guarantees the lender at least 88% of the “as is” appraised value.

VA guarantees the lender at least 88% of the “as is” appraised value. A VA appraisal is usually automatically ordered once the debtor becomes 60 days past due.

A VA appraisal is usually automatically ordered once the debtor becomes 60 days past due. The appraisal value can be appealed by the homeowner.

The appraisal value can be appealed by the homeowner. The VA will work with the homeowner and do everything possible for the homeowner to retain VA benefits.

The VA will work with the homeowner and do everything possible for the homeowner to retain VA benefits.

Freddie Mac Loans (FDMC)

FDMC Loan Quick Facts:

Freddie Mac will not allow the buyer of a short sale property to be anyone but an individual. This means the buyer on the Purchase and Sale Agreement and HUD 1 cannot be a company, LLC, trustee, or anything of the sort. The purchaser must be an individual name.

Freddie Mac will not allow the buyer of a short sale property to be anyone but an individual. This means the buyer on the Purchase and Sale Agreement and HUD 1 cannot be a company, LLC, trustee, or anything of the sort. The purchaser must be an individual name. Freddie Mac will almost always require that the property be listed with a Realtor, which means they are going to ask for a Listing Agreement. If the offer nets the lender less than 92%, Freddie Mac will require that the property is listed for at least 90 days before approval will be issued.

Freddie Mac will almost always require that the property be listed with a Realtor, which means they are going to ask for a Listing Agreement. If the offer nets the lender less than 92%, Freddie Mac will require that the property is listed for at least 90 days before approval will be issued. The lender has the authority to approve short sales at a threshold of 92% or higher. Anything lower than 92% must be approved by Freddie Mac.

The lender has the authority to approve short sales at a threshold of 92% or higher. Anything lower than 92% must be approved by Freddie Mac. Freddie Mac has a high customer service standard, which means that if the lender is not responsive to your offers, they are going to want to know about it. This creates another point of leverage to get your offer accepted.

Freddie Mac has a high customer service standard, which means that if the lender is not responsive to your offers, they are going to want to know about it. This creates another point of leverage to get your offer accepted.

Fannie Mae (FNMA)

FNMA Loan Quick Facts:

Fannie Mae has a high customer service standard. If the lender is not responsive to your offers, they may actually step in and take over the short sale negotiation process.

Fannie Mae has a high customer service standard. If the lender is not responsive to your offers, they may actually step in and take over the short sale negotiation process. The lender has the authority to approve short sales at a threshold of 90%-92% or higher. Anything lower than 90% must be approved by Fannie Mae.

The lender has the authority to approve short sales at a threshold of 90%-92% or higher. Anything lower than 90% must be approved by Fannie Mae. Fannie Mae rarely requires that the property be listed with a real estate agent.

Fannie Mae rarely requires that the property be listed with a real estate agent. Fannie Mae will allow the lender the authority to approve short sales at a threshold of 90% or higher, but will also allow a heavier discount if needed.

Fannie Mae will allow the lender the authority to approve short sales at a threshold of 90% or higher, but will also allow a heavier discount if needed.

Conventional, FHA, VA, and Fannie Mae Short Sales

The buyer can be any entity, company, person, or trust (the bank may require written proof of the company or of the trust).

Most of the loans that you come across regarding short sales are going to be conventional loans.

Your Take

Give me a shout out below with your thoughts on short sale offers. What techniques have worked for you?