I recently had the chance for another “deal stories” interview, this time with Patrick Riddle of Charleston, SC.

I recently had the chance for another “deal stories” interview, this time with Patrick Riddle of Charleston, SC.

(No, that’s not really him in the picture. We’re all fans of old-school Batman, right? I mean, who isn’t?…)

Our interview is a case study of two of his deals at 3015 Morningdale and 1972 Teakwood…each with a little different flavor, some great takeaway lessons and nice profits to sport.

We dig into…

- exactly how the leads were acquired,

- the seller’s motivation for selling,

- specifically how the deals were structured, and

- chosen exit strategies.

And in the midst of it all, we extract some important lessons every investor should be mindful of.

I think you’ll really enjoy listening in…

In addition to his real estate investing endeavors, Patrick runs another great REI blog. Please pay him a visit and tell him I said “hi” when you do. 🙂

Pictures and Comments from Patrick

To the right is a picture of 3015 Morningdale, and here’s what Patrick says about it in his own blog post…

“…we only had to do some cosmetic work to the property. This consisted of repainting the interior, putting new carpet throughout, cleaning up the landscaping, and knocking out the punch list. It cost us between $7K and $8K if I remember correctly.”

“One of the great things about the partner that we brought in to finance this property was that he had experience doing renovations himself. Since we were pretty green being newbies ourselves, he stepped in and managed the repairs that were needed. And a great long term relationship was created with him. I’ve borrowed money from him, lent him money, wholesaled deals to him, and partnered on a few other deals over the years.”

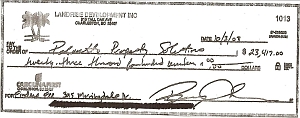

“As I mentioned in the interview, the net profit on the deal for our portion (75% of the profit) was right over $23K. Here’s the check…”

And here’s some “after” pics of 1972 Teakwood, along with his blog comments…

“We knocked out walls, reorganized the entire kitchen, uncovered hardwoods under the carpet, added a half bath, and put in tons of upgrades (crown molding, chair rails, picture frame molding, tile, etc). Oh yeah, we added the sidewalk too, and it made a big difference in the curb appeal.”

You make a good interviewer JP!

Have to say that I like the post title. Are you sure that’s not me in the pic???

Great content and tips!

Thanks for sharing!